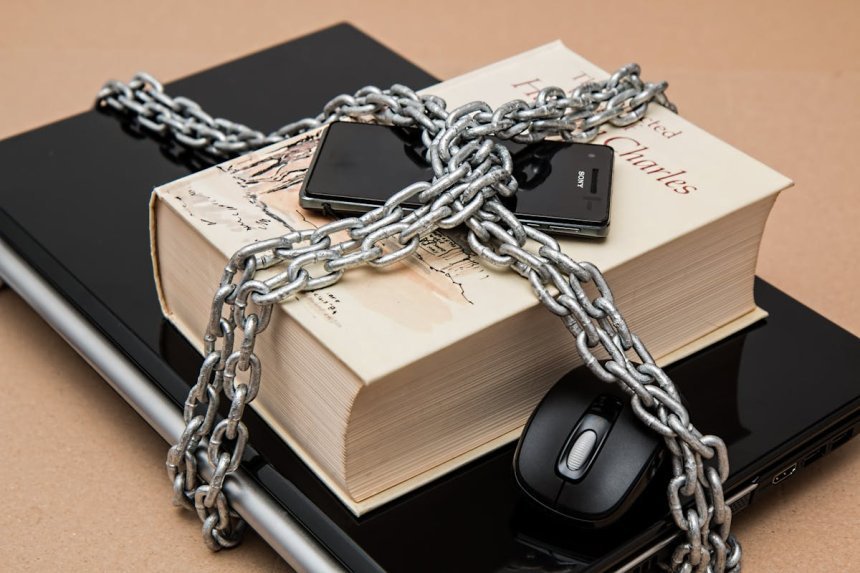

Security Challenges and Opportunities in the Open Finance Ecosystem

In this article, we will explore the intersection of challenges and opportunities that permeate the Open Finance ecosystem , explaining what the technology is, examining how it is reshaping the financial landscape, and the crucial steps to ensure that users can explore this new world with confidence.

In this article, we will explore the intersection of challenges and opportunities that permeate the Open Finance ecosystem , explaining what the technology is, examining how it is reshaping the financial landscape, and the crucial steps to ensure that users can explore this new world with confidence.

The promise and complexity of Open Finance: what it is and its importance in the financial sector

Open Finance is an approach that enables interoperability and sharing of financial data between different financial institutions and authorized third parties. This is typically achieved through APIs (Application Programming Interfaces), which allow customers to share their financial information with other institutions such as banks, fintechs, and financial service providers.

The importance of Open Finance in the financial sector is significant for several reasons:

- Open Finance fosters innovation by enabling new entrants to enter the market and develop more accessible and convenient financial services for consumers. This can include improved lending offerings, personalized investments, and more intuitive banking experiences.

- It gives consumers control over their own financial data , allowing them to share it with services of their choice , creating healthy competition and allowing consumers to choose the services that best suit their needs.

- It can increase financial inclusion by making financial services more accessible to people who previously had no access to them. This is particularly important in regions where traditional banking infrastructure is limited.

- It helps increase transparency in the financial sector as consumers can have a better understanding of their finances and the offers available.

- While data security and privacy are important challenges to address, Open Finance also offers the opportunity to establish rigorous standards for security and user consent , making data sharing safer than traditional methods.In short, Open Finance is reshaping the financial industry, providing greater connectivity and opportunities for innovation , while placing a renewed focus on data protection and consumer choice.

Privacy and data protection in Open Finance

Privacy and data protection in Open Finance are of utmost importance , considering that this ecosystem involves sharing sensitive financial information of users. Here are some ways in which privacy and data protection are addressed in Open Finance:

- User Consent: The fundamental principle of Open Finance is user consent. Customers must give explicit permission to share their financial data with third parties.

- Security standards: Financial institutions and service providers in Open Finance are required to adopt rigorous security measures to protect customer data. This includes strong encryption, multi-factor authentication, and protection against cyber threats .

- Rules and regulations: Regulations such as the General Data Protection Regulation and specific Open Banking regulations in different countries set strict guidelines for the handling of personal and financial data. Institutions must comply with these regulations or face substantial fines.

- Limited Access: Access to customer financial data is strictly controlled and limited to only the information necessary to provide a specific service. Authorized third parties may only access specific data with the customer’s authorization.

- Monitoring and auditing: Financial institutions are required to regularly monitor and audit data access and usage, helping to identify and mitigate any misuse or privacy breaches.

Innovation Opportunities in Open Finance Security

Security opportunities in Open Finance technology are intrinsically linked to the challenges that this ecosystem presents. Here are some of the security opportunities that can be explored:

Advanced authentication

Open Finance enables the implementation of advanced authentication methods such as multi-factor authentication (MFA) and biometric recognition , making it more difficult for attackers to gain unauthorized access to financial data.

Suspicious activity monitoring

Open Finance platforms can use behavioral analytics to detect suspicious or unusual activity , such as unusual transactions, fraudulent emails, or logins from unusual locations.

Blockchain and Distributed Ledger Technology (DLT)

The use of blockchain and DLT in Open Finance can offer opportunities to create highly secure and transparent financial records, reducing fraud and errors.

Smart contracts

Smart contracts on blockchain can automate financial transactions , ensuring that they only occur when all conditions are met, which increases transaction security.

Enhanced privacy

Cryptographic techniques such as secure multiparty computation (MPC) can be employed to allow parties to share information without revealing the raw data, protecting privacy.

Continuous third party monitoring

Financial institutions can implement rigorous processes to continually monitor authorized third parties that have access to customer data, ensuring they comply with security standards.

Staff training

Investing in cybersecurity training for employees is essential. Educating employees about safe practices can help prevent insider threats.

Collaboration and standards

Collaboration between financial institutions, regulators and standards bodies is critical to developing consistent security guidelines and best practices that apply across the industry.

Incident Response

Having robust incident response plans in place is crucial to minimizing damage in the event of a security breach. This includes taking swift action to mitigate threats and notifying affected parties.

Open Finance offers a wealth of opportunities to implement advanced security measures and innovative technologies to protect users’ financial data. However, these opportunities also come with the responsibility to proactively and consistently address security challenges to ensure customer trust in the ecosystem.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0