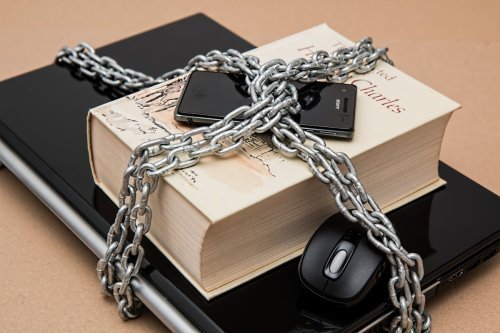

9 Financial Management Mistakes Every Company Should Avoid

In order to carry out financial controls, all profits, expenses, costs, investments, and income and expenses in general must be properly accounted for. This must be done with the help of spreadsheets or, even better, with financial management software .

One of the pillars that makes your company stay in the market for a long time is the way the entrepreneur manages his resources to avoid errors in financial management.

In order to carry out financial controls, all profits, expenses, costs, investments, and income and expenses in general must be properly accounted for. This must be done with the help of spreadsheets or, even better, with financial management software .

Therefore, keeping everything organized, through a cash flow, for example, allows your business to last for many years in the market. This is the importance of financial management in organizations .

But what precautions can you take to ensure that your company doesn’t end up “spending more than it can afford”? To avoid this, check out these 9 main financial management tips:

- Not using the profit obtained correctly

- Not understanding that personal finances are different from business finances

- Keeping poorly sized stocks

- Not setting clear goals and performance indicators

- Inadequate pricing

- Not tracking cash flow

- Not maintaining a single source of information

- Accumulate debts

- Not analyzing your indicators monthly

Why prevent errors in the financial management of your business?

In addition to preventing your company from declaring bankruptcy even if it is newly launched on the market, these errors may affect other areas of your business.

If you need to acquire new technologies, employees or expand your business, none of this will be possible if you, the entrepreneur, do not know how to properly manage your cash flow.

The importance of financial management in organizations is correlated with the functioning of companies in the market.

Be a visionary! Focus on making your company take off, but without taking on absurd debts that could make it impossible for the business to be sustainable.

Check out 9 examples of inadequate financial management and avoid committing them in your company.

Financial Management Tips: 9 Mistakes You Should Avoid

To avoid a collapse or errors in the financial management of your business, there are some precautions that can be taken so that your cash flow is maintained in a positive manner.

1. Not using the profit obtained correctly

Profit must be preserved, creating a reserve for emergencies, in addition to setting aside a percentage for investment in the company.

This can be materialized in the purchase of new equipment and software, expansion of facilities, creation of branches, increase in workforce, training, etc.

Simply distributing profits whenever they occur can compromise the long-term viability of the business .

2. Not understanding that personal finances are different from business finances

This is a more common mistake in micro-businesses, smaller organizations.

The Legal Entity's current account, which corresponds to the company's, cannot be mixed with the partners' personal accounts.

This way, the entrepreneur will receive the money from the operations directly into his company's account, preventing the profit from being used for his own benefit, without thinking about the business's obligations.

3. Keeping poorly sized stocks

When investing in the acquisition of new items to replenish stock, it is ideal to take stock of the quantity that was sold in the last two months.

Having this parameter prevents an excessive purchase from being made, which will only take up space in the stock.

Even if it is a new item that will be sold in your company, it must be purchased in quantities that correspond to the expected demand.

Both excess inventory, which brings unnecessary expenses, and lack of product (and loss of sales) are bad for business. Carefully study your seasonality and the state of the economy before restocking your goods.

4. Not setting clear goals and performance indicators

If the entrepreneur does not define his goals, his business will not take off.

You need to set profit targets, but not only these. There are several other financial performance indicators that you should monitor.

5. Inadequate pricing

When pricing your service or products, keep in mind that it is not your company that sets the price, but the market.

It is not always possible to have a high profit margin, because this can reduce sales. On the other hand, sometimes we are selling too cheaply, in large quantities, but we are not able to cover operating costs.

Therefore, by offering fair prices, where both parties benefit, you can generate more profits than selling expensive products, which will be a sales failure.

6. Not monitoring cash flow

When a company does not keep track of the inflow and outflow of money, it is very likely that it will not realize that it will soon not have enough resources to honor its commitments.

This is a control that cannot be missing in any business!

7. Not maintaining a single source of information

If each sector of the company maintains its own financial controls, the numbers will certainly not add up.

It is essential to have a person or department in charge of this and to share the information through software or shared spreadsheets online.

8. Accumulating debts

If your company has the possibility of using credit and sees a good investment opportunity, using this capital source can be a great idea.

But you need to be careful when debts accumulate or when credit is used to plug cash holes.

9. Not analyzing your indicators monthly

To know if everything is going well and to set new goals, carrying out a monthly analysis of the indicators is essential.

This way, the entrepreneur will be able to know whether or not he can continue on the same path, or whether it is necessary to make some adjustments to the route of the enterprise.

Share

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0